We use AI to scan for innovation in business, academia and policy. We offer insights on where change is happening, identify what’s gaining momentum, and suggest what developments we might see in the future.

This edition is on Nesta’s sustainable future mission and innovations to improve the affordability of low-carbon heating.

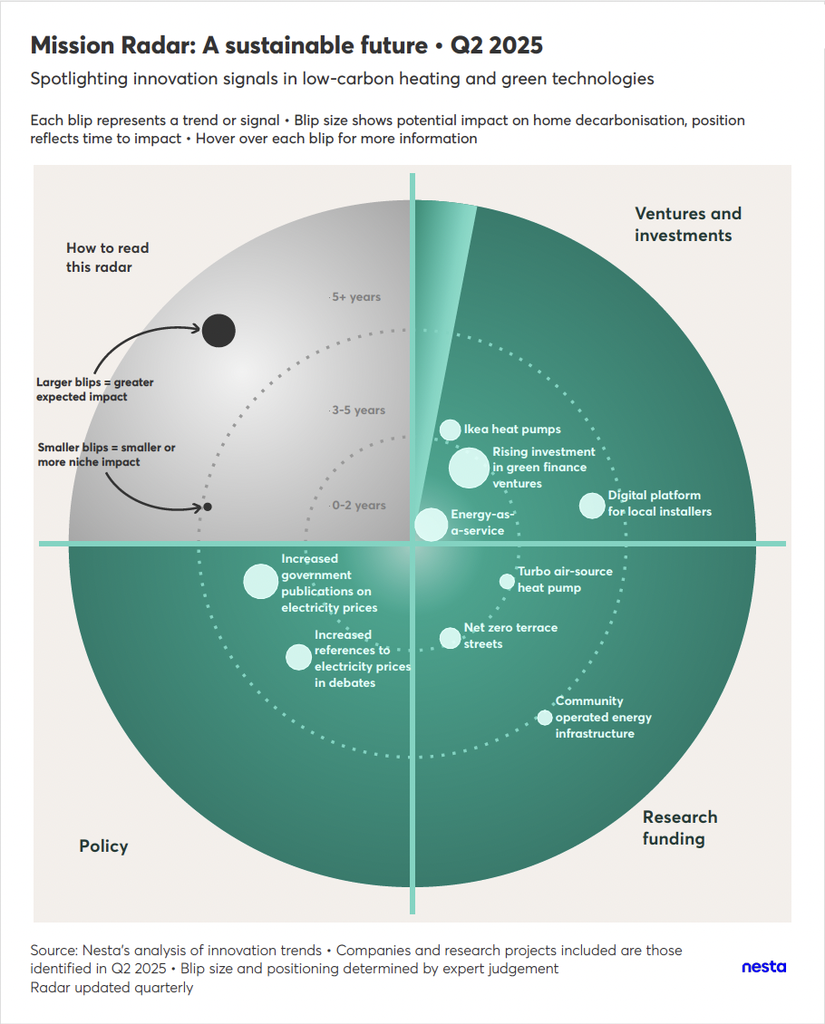

Mission Radar: A sustainable future • Q2 2025

Mission Radar chart (a type of bubble chart) for Nesta's "A sustainable future" mission, updated Q2 2025.

The radar is divided into four quadrants representing categories of innovation: "Ventures and investments" (top right), "Research funding" (bottom right), "Policy" (bottom left), and an unlabeled top-left quadrant (representing trends that are not primarily investment, funding, or policy). A dashed vertical line separates signals in the "Policy" and unlabeled quadrant from those in "Ventures and investments" and "Research funding."

Blips are positioned based on time to expected impact, from the center outwards: "0-2 years," "3-5 years," and "5+ years."

Blip size indicates potential impact on home decarbonisation, with larger blips signifying greater expected impact and smaller blips signifying smaller or more niche impact.

Main Trends and Findings (Blips):

Source: Nesta's analysis of innovation trends. Companies and research projects included are those identified in Q2 2025. Blip size and positioning determined by expert judgement.

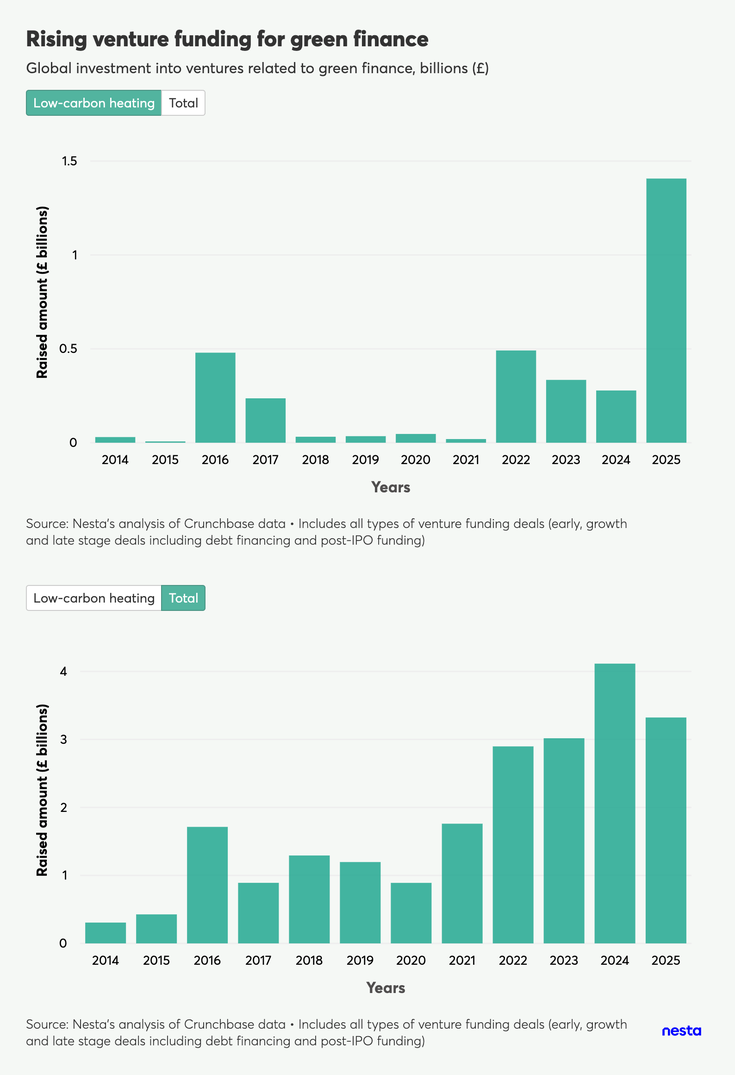

Global investment in businesses that offer loans and other financial products for low-carbon heating has risen significantly in 2025. The market has grown unevenly since 2021 as the broader green finance market, which includes any financial activity used to fund initiatives that deliver positive environmental outcomes, has expanded. This year’s spike in funding is driven by two major debt financing rounds for American company Palmetto and German fintech Bees and Bears, totalling around £1.4 billion.

Rising venture funding for green finance

Two comparative bar charts showing global venture investment over time. These represent two selectable views within a single visualization: Low-carbon heating and Total green finance.

Nesta's analysis of Crunchbase data. The data includes all types of venture funding deals, such as early, growth, and late stage deals, as well as debt financing and post-IPO funding.

Axes and Units (Both Charts):

Chart 1: Low-carbon heating investment

Chart 2: Total green finance investment

Comparison (2025 Data): Investment in low-carbon heating (£1.4 billion) accounts for a significant portion of the total green finance investment (£3.2 billion) in 2025.

Palmetto secured $1.2 billion (£980 million) to expand its zero-upfront-cost model, enabling homeowners to install solar, heating, cooling and energy storage systems via monthly instalments.

Bees and Bears raised €500 million (£420 million) to roll out its financing product, which allows customers to pay in instalments when purchasing green home upgrades from small businesses. Whereas previously private households were often limited to choosing between a few large online installers who offered payment plans, Bees and Bears’ financing product gives households access to a much wider range of suppliers when looking to install heat pumps, solar or batteries on credit.

The magnitude of these green finance deals is significant, and it’s notable that they occurred in two different global regions. The fact that funds were raised via debt financing, as opposed to equity financing, points to a degree of business maturity: it indicates the business has a stable financial foundation, a proven ability to generate revenue and assets to use as collateral.

In the UK, green finance for consumers is available through products like green mortgages offered by some high street banks and specialised lenders, but there is limited UK venture activity in this space. To expand the availability of options for both lenders and consumers, the government launched a consultation on Consumer Credit Act reform in May 2025, which specifically looks at how reforms to the regulation can support the wider rollout of green finance products.

High upfront costs remain a major barrier to green home upgrades such as heat pump installations. A 2023 Nesta study found 55% of people in the UK would make green home upgrades if they had financial support. It’s clear that major investment activity in green finance products for decarbonising homes is needed and we hope to see this recent increase of investment sustained.

These low-carbon heating announcements from businesses in Q2 2025 stood out for their potential to accelerate home decarbonisation.

Heating announcements

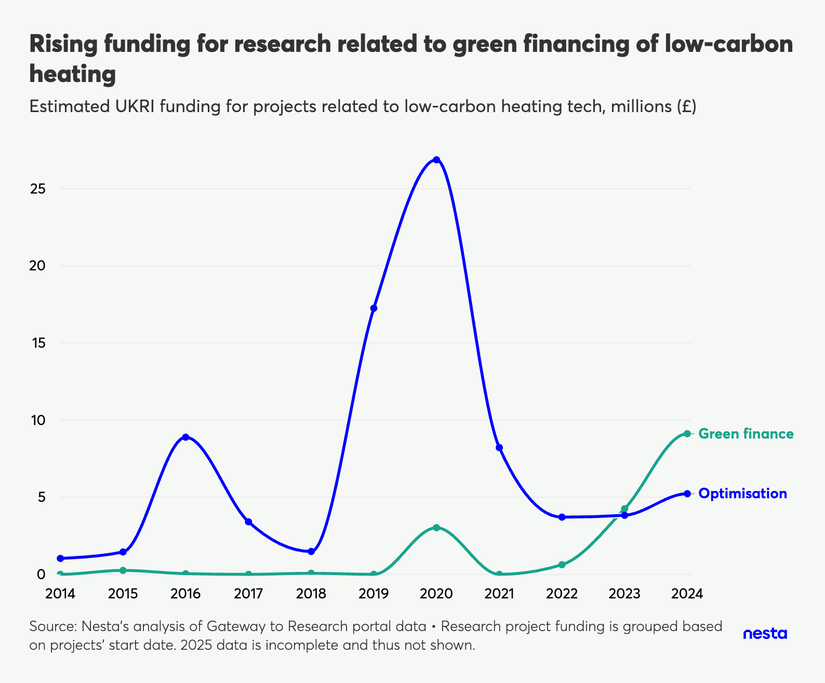

The number of affordability-focused low-carbon heating research projects funded by UK Research and Innovation (UKRI) fluctuated between 2020 and 2024. New awards totalled over £14 million in 2024, below the peak of around £27 million in 2020.

Before 2023, most awards went to projects focused on optimising low-carbon heating systems, through efficiency improvements and installation-related innovations. Funding for these types of projects accelerated in 2019 and peaked at just below £27 million in 2020, including an award of more than £9 million to a consortium of universities focused on making buildings “active” so they can generate and store their own energy. This spike in project funding followed the UK’s net zero legislation in 2019 and subsequent announcement of major research funding programmes, such as the £104 million prospering from the Energy Revolution challenge fund.

Annual awards for low-carbon heating optimisation projects dropped to below £5 million in 2022 and have stayed at that level since. Over the same period, awards for research on the financing of low-carbon heating have risen to just under £10 million in 2024. One example is Let Zero, which secured £2.4 million in 2024 to explore options to help decarbonise the private rented sector, including through helping landlords access grants and green financing to upgrade properties. This trend towards green finance research activity coincides with the surge in green finance investment activity described above, and indicates a potentially strong innovation area emerging in low-carbon heating affordability.

Rising funding for research related to green financing of low-carbon heating

Line chart showing the estimated UKRI funding for research projects related to low-carbon heating technology, categorised by two streams: Optimisation and Green finance.

Nesta's analysis of the Gateway to Research (GTR) portal data. Research project funding is grouped based on the project's start date. 2025 data is incomplete and is not shown.

Axes and Units:

Key Trends (Optimisation - Blue Line):

Key Trends (Green finance - Green Line):

These research projects were active in Q2 2025 and stood out for their potential to accelerate home decarbonisation.

Research funding

Reducing the price of electricity is another key factor in making low-carbon heating more affordable, in addition to new funding models and more efficient technology. Nesta has been working on routes to rebalance bills to bring down the cost of electricity.

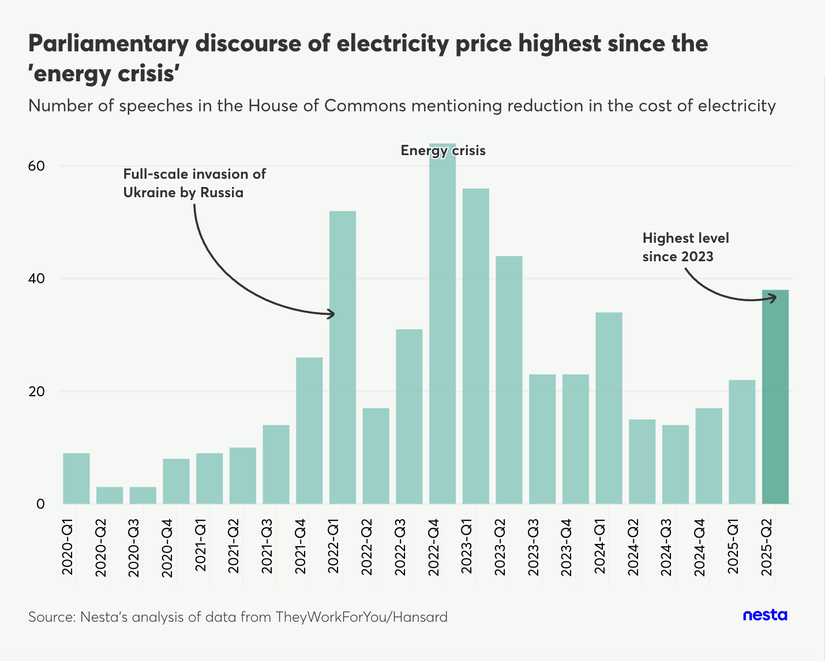

In Q2 2025, debates in the House of Commons about electricity prices were more frequent than in any quarter since Q2 2023. At that time, the discourse was dominated by the energy crisis, with the invasion of Ukraine causing a massive spike in gas, oil and electricity prices. This prompted emergency government measures like the Energy Price Guarantee. Energy prices have since fallen, even though fuel poverty rates remain high.

The current discourse focuses on longer-term policy initiatives to lower electricity prices for households and businesses, with Commons debates on topics including the Warm Homes Discount and energy prices for energy-intensive industries.

Outside of Commons debates, the first half of 2025 saw a similar uptick in government publications referencing electricity price reductions. Much of this came in the form of evidence submitted to the cost of energy inquiry, which is looking at how bills can be reduced for both domestic and commercial consumers.

Taken together, these trends indicate that there is policy momentum to reduce electricity prices, which could increase the affordability and subsequently overall appeal of heat pumps and other low-carbon heating technologies.

Parliamentary discourse of electricity price highest since the 'energy crisis'

Bar chart showing the Parliamentary discourse of electricity price in the House of Commons, specifically tracking the number of speeches mentioning "reduction in the cost of electricity."

Nesta's analysis of data from TheyWorkForYou/Hansard.

Axes and Units:

Key Trends and Findings:

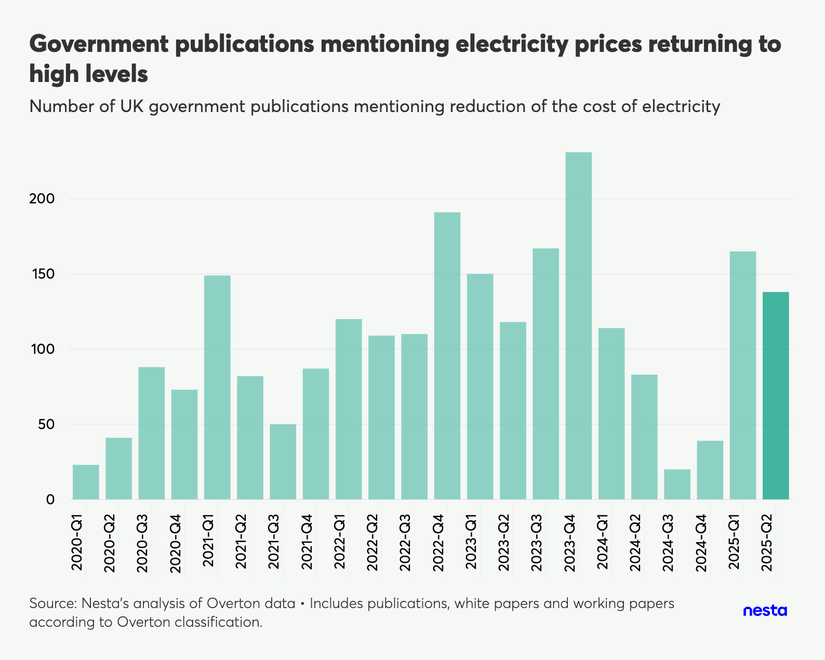

Government publications mentioning electricity prices returning to high levels

Bar chart showing the Government publications mentioning electricity prices returning to high levels, which is specifically the "Number of UK government publications mentioning reduction of the cost of electricity."

Nesta's analysis of Overton data. The data includes publications, white papers, and working papers according to Overton classification.

Axes and Units:

Key Trends and Findings:

Let us know what you think about this edition of Mission Radar. We will continue improving this format and share more innovation signals in future editions.

We sourced venture capital investment data from Crunchbase, a business information database covering more than 3 million start-ups and companies globally.

Research data was sourced from the Gateway to Research portal, which lists projects funded by UK Research and Innovation (UKRI). UKRI is responsible for funding a large proportion of UK research and development (£6.3 billion, or about 36.2% of the UK Government’s R&D expenditure in 2022).

House of Commons debates were sourced from TheyWorkForYou, a free platform managed by mySociety to make Parliament data more accessible.

Government publications were sourced from Overton, which provides access to policy documents, white papers and working papers from governments and intergovernmental organisations worldwide.

To assess relevance across green finance and low-carbon heating categories, we combined keyword filtering with zero-shot generative classification. For low-carbon heating green finance, we manually reviewed venture capital and research funding records in depth, while for low-carbon heating optimisation, we reviewed research funding records, with spot checks across other categories.

In this iteration, the approach achieved ~75% accuracy overall, with ~74% precision and ~81% recall (194 samples). In practice, we capture the most relevant items but also include some non-relevant ones, so results can be slightly over-inclusive. A review of false positives suggests this is partly because the LLM is lenient when categorising, often labelling entries on energy flexibility or storage as low-carbon heating, and treating terms like ‘cost-effective’ or ‘funding’ as signals of green finance. We’ll keep refining the approach to raise precision without sacrificing coverage in future iterations.

Our datasets have inherent limitations (such as gaps in the coverage of private R&D spending) and the semi-automated nature of our data labelling approach can result in occasional false positive or false negative results. Moreover, our method identifies data that is likely to be relevant to low-carbon heating technologies, but the nature of the associated information can vary from strong to circumstantial: for example, a technology might be the focus of a research project or just as part of a project, but not the primary focus.

Due to these caveats, we interpret the reported trends as data-informed hypotheses about the innovation system rather than a definitive picture.

For the reported growth rates, unless specified otherwise, we use a three-year rolling average and compare the years 2024 and 2020 to produce a smoothed estimate that reduces the impact of annual variability.